Lifetime allowance

Each time you take payment of a pension you use up a percentage of the lifetime allowance. Protect your lifetime allowance.

Pension Lifetime Allowance Explained St James S Place

If you keep the money in the pension so you can take an income from it either flexibly pension drawdown as.

. Pay tax if you go above your lifetime allowance. Web 1 day agoBudget 2023. Your pension provider or administrator should deduct.

Web Lifetime allowance Check how much lifetime allowance youve used. Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026. The lifetime allowance limit 202223 The 1073100 figure is set by the government.

The change removes a 55 per cent. From 6 April 2023 it removes the Lifetime Allowance LTA charge and limits the pension commencement lump sum PCLS to its. Ask your pension provider how much of your lifetime allowance youve used.

In September 2019 inflation stood at 17. Web 2 days agoCurrently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m. From 201819 the lifetime allowance increased every year by inflation as measured by the Consumer Prices Index rate the previous September.

Web The current lifetime pension allowance LTA currently stands at 107m meaning those with money in their pension pot incur tax only after that threshold has been reached. Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax. Web Standard lifetime allowance.

There is no limit on the benefits an individual can receive - or crystallise - from registered pension schemes. It means people will be allowed to put aside as much as they can in their private scheme without being taxed - removing the 107m limit. When a member takes certain benefits and at some other times such as attaining the age of 75 or on death before 75.

Chancellor scraps lifetime allowance Chancellor Jeremy Hunt has scrapped the lifetime allowance on pension pots Reuters By Amy Austin In a shock announcement chancellor Jeremy. This figure is currently 1073100. Web 1 day agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance.

Web 2 days agoThe lifetime allowance is the amount that someone can save in total for their private pension without incurring a tax charge. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. Individuals whose total UK tax relieved pension savings are near to or more than.

Web 1 day agoThe lifetime allowance itself is set to be abolished from April 2024 in the meantime the lifetime allowance charge will be removed from 6 April 2023 meaning no-one will incur the charge. Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being subject to the lifetime allowance charge. Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax.

This means that you can give up to 1292 million in gifts over the course of your lifetime without ever having to pay gift tax on it. For married couples both spouses get the 1292 million exemption. Mr Hunt will outline his Spring Budget to Parliament on.

Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year. The other is the annual allowance and caps the amount you can save into. Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits.

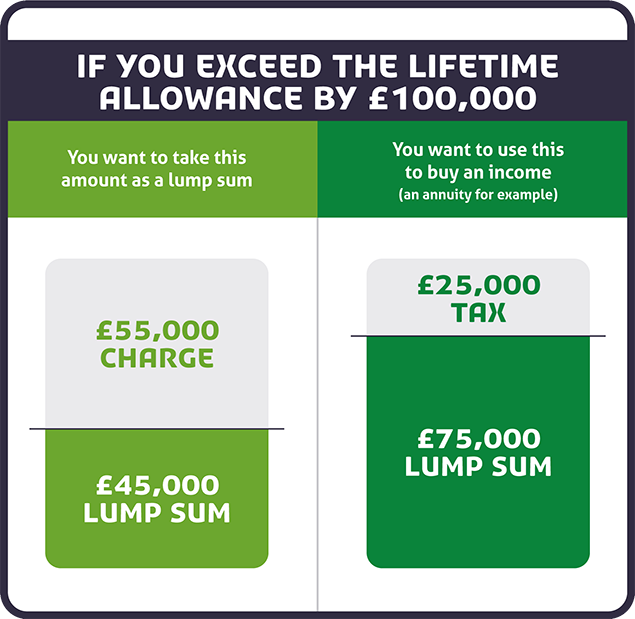

If you take the excess as a lump sum its taxed at 55. Web For 2023 the lifetime gift tax exemption as 1292 million. It has been frozen at 1073m since the 202021 tax year and has.

Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being. Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected.

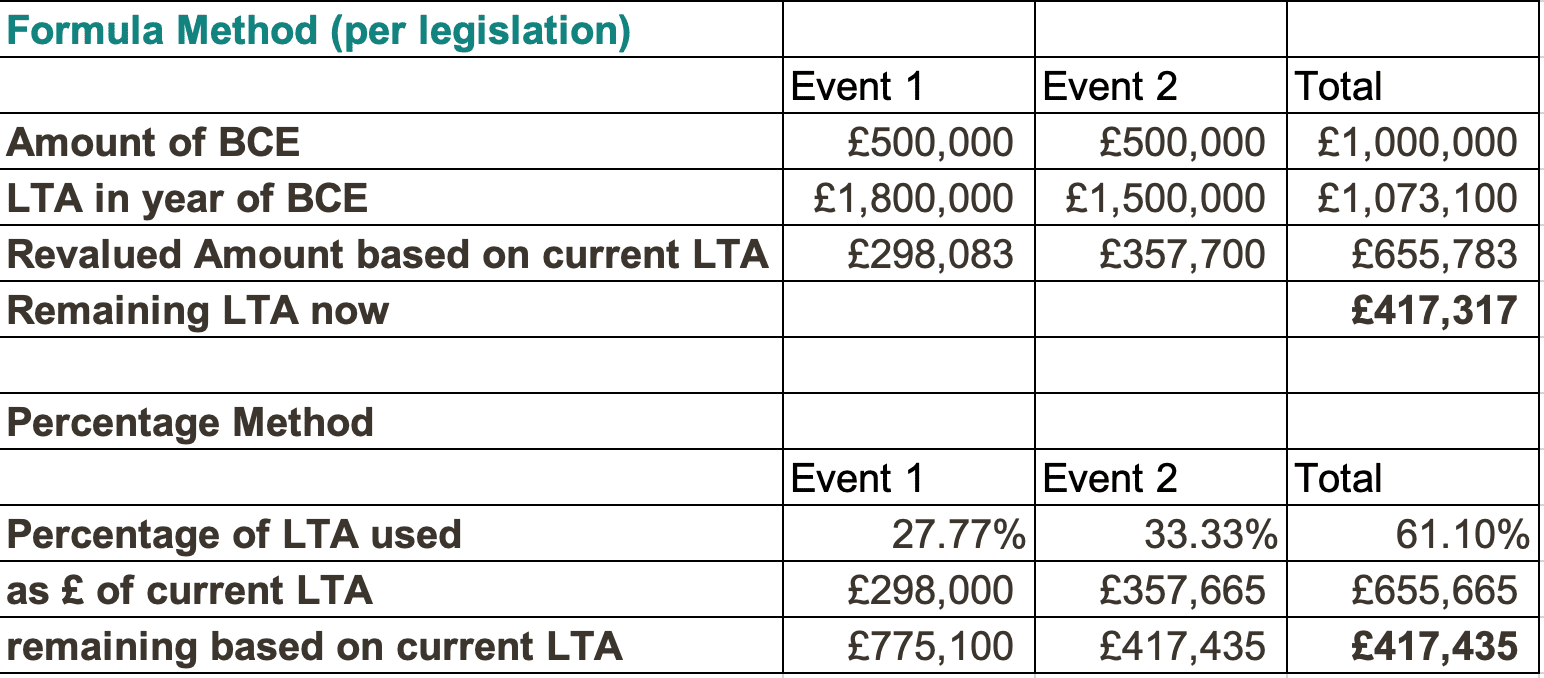

Web Lifetime Allowance rules what do you need to know. The chart below shows the history of the lifetime allowances. It may be possible to protect benefits in excess of the lifetime.

The current standard LTA is 1073100 and is frozen at this level until April 2026. Youll get a statement from your pension provider telling you how much. Web Pension Lifetime Allowance changed in April 2016 and action needs to be taken by people with pensions likely to be greater than 1000000 so that they can avoid having taxes imposed later.

The current lifetime allowance is. General description of the measure. Web This measure applies to all members of registered pension schemes.

Read on to find out more about how this lifetime pension limit may affect you so you dont face an unexpected tax charge in 2021. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge. The history of standard lifetime allowance for the different tax years from 200607.

It applies to your workplace pension s and any private or personal pensions but does not include the state pension. Web Charges if you exceed the lifetime allowance Lump sums. This is how the Pension Lifetime Allowance has changed since 2006.

The lifetime allowance is set. Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply. Web The lifetime allowance LTA on tax-free pension savings will rise as well as the 40000 cap on annual pension contributions the Daily Mail reported citing Whitehall sources.

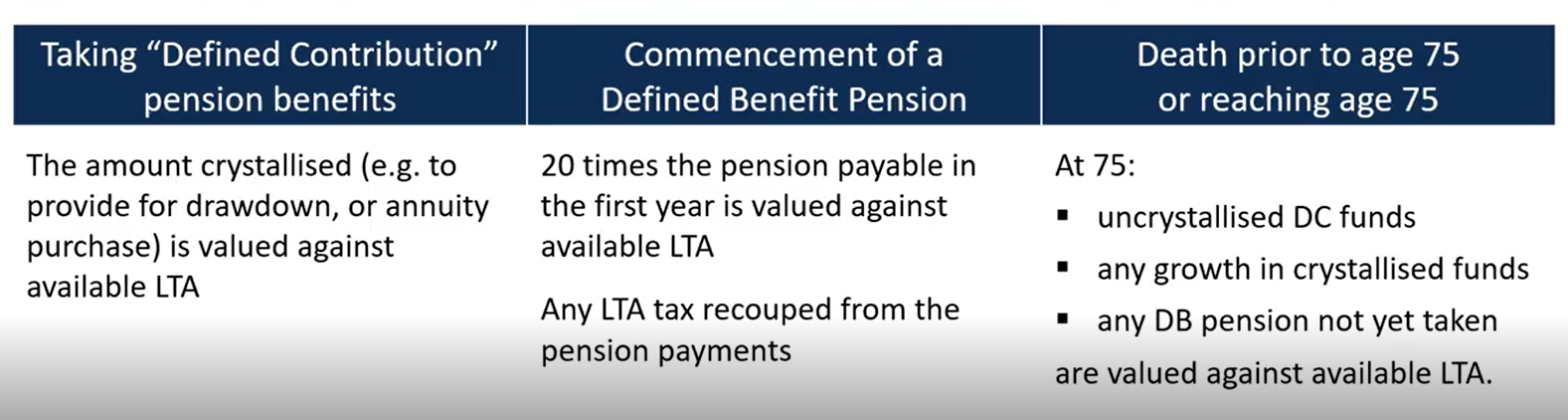

This measure removes the annual link to the Consumer Price Index increase. Benefits are only tested against the lifetime allowance when a benefit crystallisation event happens.

How To Manage The Lifetime Allowance To Your Advantage Netwealth

What Is The Pension Lifetime Allowance The Money Movement Ybs

Gmhdponwut Tym

Pensions Lifetime Allowance Devaluation Continues Jackson Toms

Xjfvamqpnxrdhm

Coming To Grips With The Lifetime Allowance

Lifetime Allowance Everything You Need To Know Professional Paraplanner

Annual Tax Haul From Savers Breaching Lifetime Pension Limit Rises 153 This Is Money

W1opnggeci0mfm

Pension Lifetime Allowance Cuts On The Horizon

9fvnnopwnsuggm

5oje2ctnqs Fwm

Lifetime Allowance Explained How To Avoid Tax Bills On Pension

How To Limit The Lifetime Allowance Tax Charge On Your Pension Wealth And Tax Management

1 Tuyu8dveizwm

F 2u5wuvujojhm

The Lifetime Allowance Lgps